Marketing

Your Ultimate Guide to Marketing Automation for Financial Services

by Amy Montague

Marketing Automation has played a huge role in the success of many financial services, such as accounting and legal, when nurturing and engaging customers throughout their journey. Unlike other industries such as manufacturing or retail where the marketing focus is primarily on guiding customer journeys towards a purchase, financial services marketing focuses on improving customer and prospect experiences, loyalty and trust.

As brandmuscle puts it “This is especially beneficial for financial services companies, where relationships play a central role in developing the trust that converts prospects and maintains customers.”

Finances are often the reason for many sleepless nights as money worries can induce high amounts of stress. For financial services, providing customers with a personalized experience which caters to their specific needs can greatly reduce consumer stress while increasing trust and loyalty.

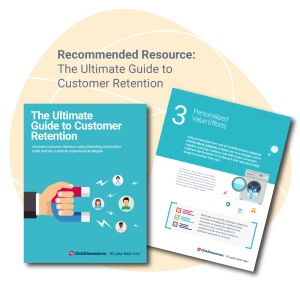

Did you know that a survey revealed that trust was the most valued aspect of banking for customers? – Source

Marketing Automation solutions provide the building blocks for financial services to improve their marketing strategies and prospect journeys through a range of intelligent tools.

Here are the top 3 Marketing Automation tools financial services need to use:

Email Marketing

Email Marketing is one of the many core pillars in any marketing strategy, regardless of industry. In the case of financial services, email marketing provides the tools to nurture and engage with customers on a more personal level.

Email can be used to provide relevant content, facilitate updates about business changes/improvement and even send over event invites.

Delivering these types of emails supplies a ‘drip feed’ type strategy which provides the right content at the right time based on a specific set of triggers. Triggers in this instance refers to when a customer/prospect fills out a form or clicks on a tracked link and an automatic process is then ‘triggered’ to instantly provide the customer with the content/experience they want. This not only improves your

Email marketing in the financial sector has an average conversion rate of 5.8%, presenting a great opportunity for these businesses to use automation and drive more conversions!

Want to see Marketing Automation for the financial sector in action? Check out our new financial services software case study here!

FREE DOWNLOADABLE RESOURCE: The Ultimate Guide to Customer Retention

Web Intelligence

The financial service sector has access to some of the most secure data in the world and those working within the industry are usually accustomed to crunching numbers and examining high-level data. Your marketing team should be the same!

Did you know that 41% of web traffic for the finance industry came from an organic search? – source

Web intelligence data includes but is not limited to site visits, page views and form captures. And using the right connections, this data can then be integrated into a CRM, and automatically triggered into a workflow which can provide more detailed reports.

For financial services this type of quality data allows your marketing teams to track, engage with and learn more about your customers/prospects. Opening up the opportunity to refine your efforts and provide a more personalized experience.

Subscription Management

Ever been bombarded by marketing emails, texts or letters trying to sell a certain product which you have no interest in? Experiencing this type of marketing is not only annoying but also puts a bad taste in your mouth. This stems from the feeling that the business trying to market to you doesn’t understand you as an individual customer.

The same goes for financial services. Customers don’t want to receive messages which provide no value to them and also don’t match how frequently they want to be contacted.

This is where subscription management comes in.

Subscription management is “designed to maximize value for the customer while providing greater revenue predictability and resource allocation forecasting for businesses.”

This tool allows customers to adjust their preferences and marketing frequency instantly, providing a smoother, more personalized experience which not only improves engagement but also trust and loyalty as all needs are met.

Subscription management also opens an opportunity for revenue increases as customers are guided through specific journeys, while your marketing team gains greater insight into the areas/topics of the business which are most impactful.

Subscription management will be especially important over the coming months as the FCA has confirmed plans which “will fundamentally improve how firms serve consumers” through higher and clearer set standards concerning customer protection and needs.

Final Thoughts

Marketing Automation presents so many opportunities for the financial services sector to improve their marketing efforts and customer experiences, with the core strategy focusing on and facilitating rising customer trust and loyalty. Above we have explored just three examples of the power of Marketing Automation tools specifically catered to the financial services sector, but there are many more ways in which Automation can be utilized!

Want to find out more about Marketing Automation for the financial services sector? Talk to our team here.